GOVERNANCE

1

2

3

4

Promotion Structure

The G Team within the ESG Promotion Department plays a central role in setting annual targets and promoting initiatives aimed at stringent corporate governance and enhanced compliance. The details of activities carried out by the team are reported at regular meetings of the ESG Promotion Group held on a monthly basis and reflected in the management structure, including the Board of Directors, under the responsibility of the head of the President’s Office.

The administrative department plays a central role in governance and promotes the development and enhancement of related systems.

Corporate Governance

Basic Thinking on Corporate Governance

We regard corporate governance as a critical factor, both in implementation and continued reinforcement, in becoming a vital entity within society. Corporate governance is key to achieving enduring growth in corporate value and enhancing corporate transparency and soundness based on our purpose, vision, and principles of action.

Fiscal 2024 Results

Board of Directors meeting attendance:

100%

Compliance training sessions:

4 (for employees and officers)

Risk Management Committee meetings:

60

Corporate Governance Structure

Details of each body

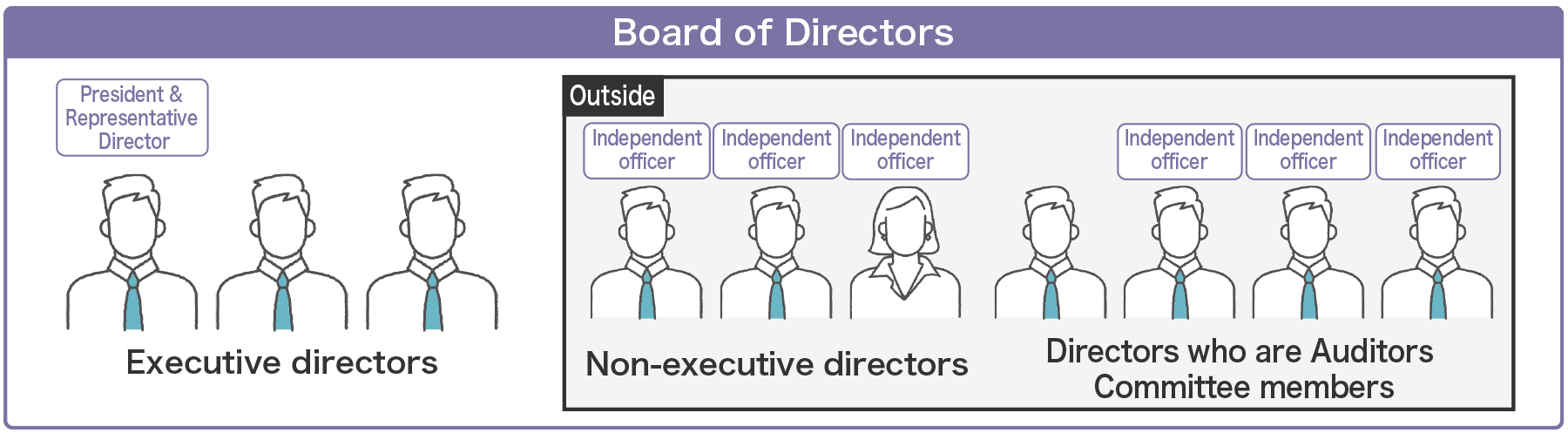

(1) Board of Directors

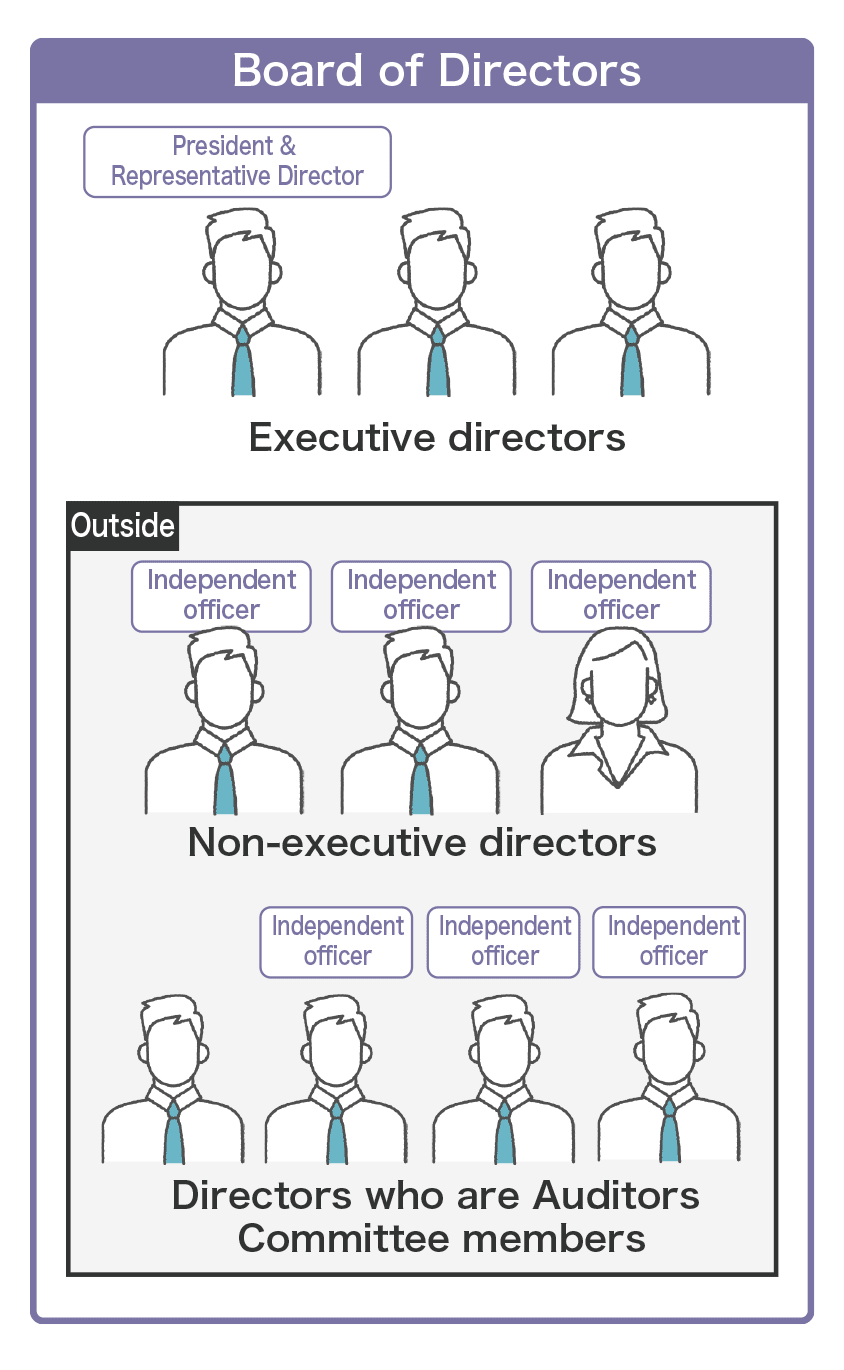

The board of directors consists of ten members: three executive directors, three non-executive directors, and four directors who are members of the Auditors Committee. To enhance management oversight functions, the six independent external directors are the three non-executive directors and three of the four directors who are members of the Auditors Committee.

The board of directors in principle meets at least once a month to enhance management oversight functions through thorough deliberation and review of important matters.

To secure speed and dynamism in business execution, the Articles of Association require the delegation of decision-making on important matters of business execution to executive directors. The scope of such delegation is managed strictly in accordance with monetary and other standards set forth in the Job Authority Rules approved by the board of directors. The state of the execution of important delegated business matters is promptly reported to the board of directors.

(2) Auditors Committee

To enhance its independence three of the four Committee members are independent external directors.

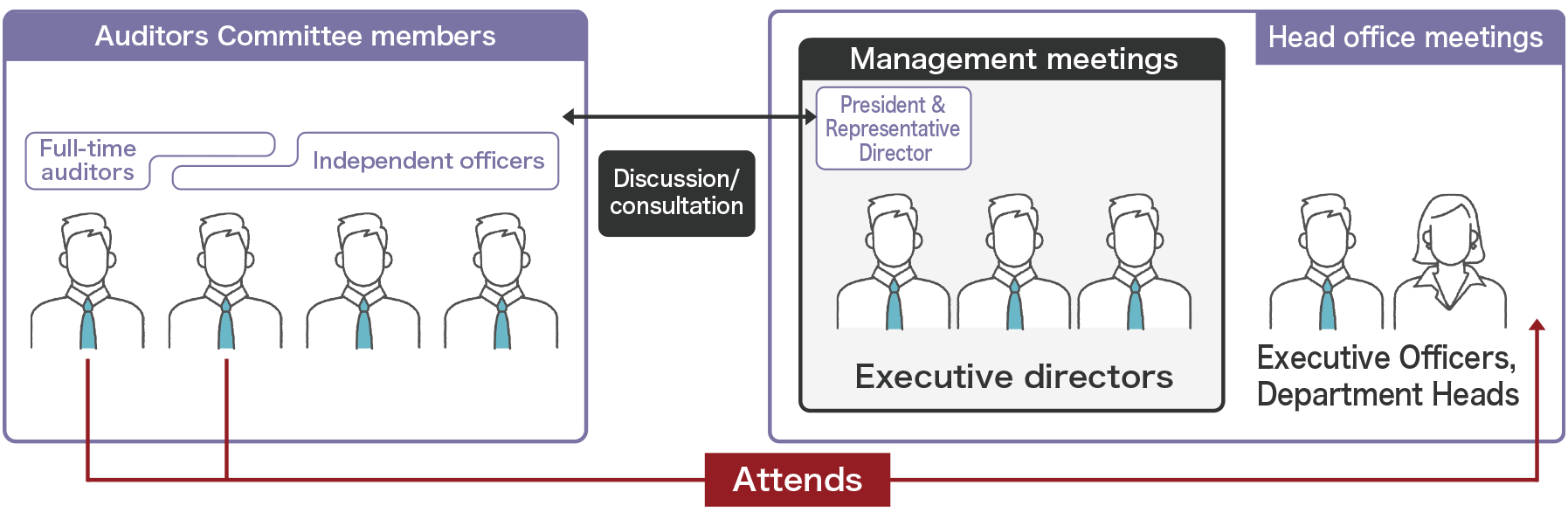

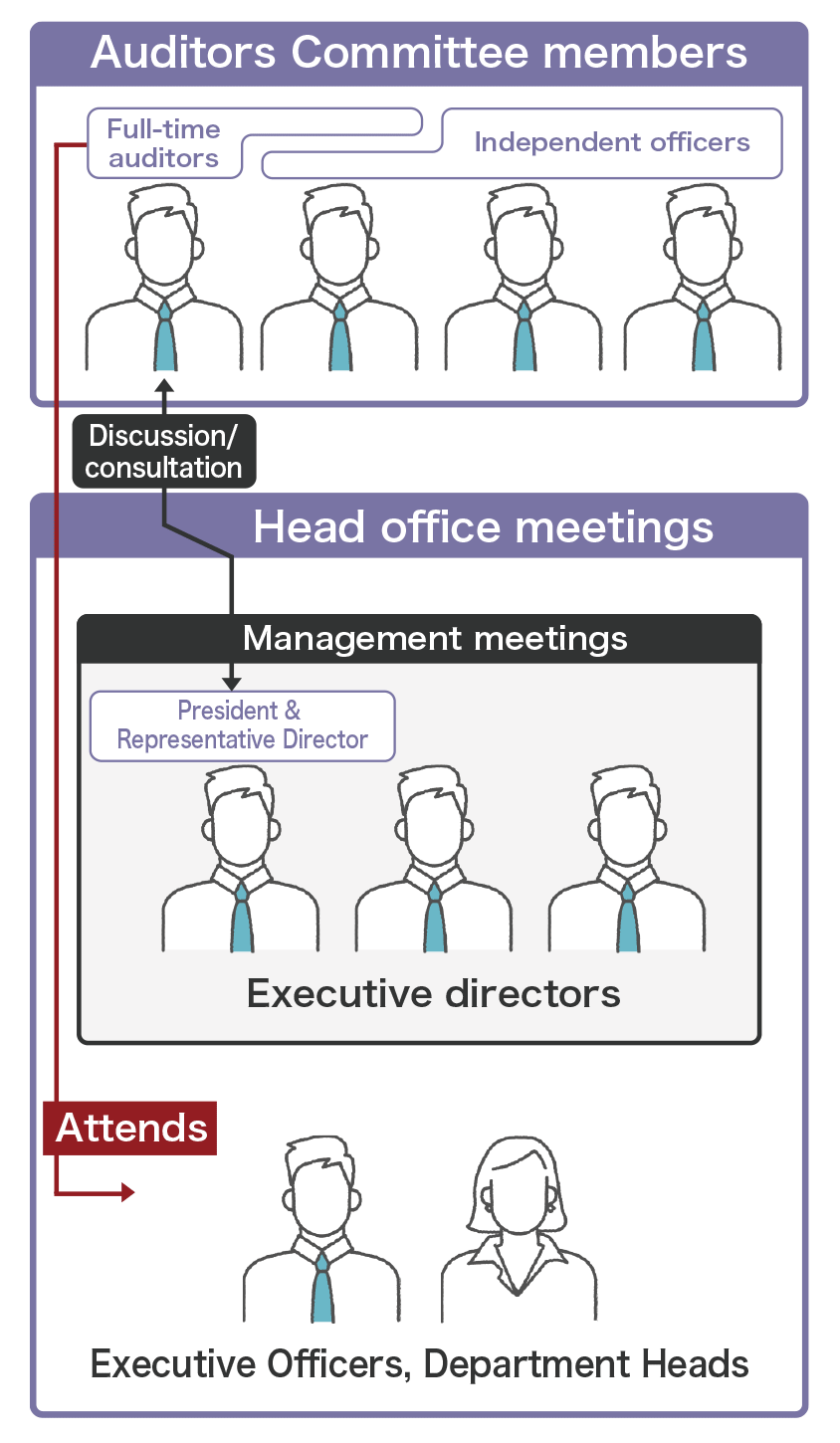

The Auditors Committee in principle meets once a month. If required by Auditors Committee members, the accounting auditor and internal auditing staff, as well as members of senior management, including executive directors, attend these meetings to provide timely and appropriate reports.

Auditors Committee members engage in the periodic exchange of perspectives with the President and Representative Director and, if necessary, interviews with members of senior management, including executive directors, striving to ascertain the state of business execution and related issues in individual business departments.

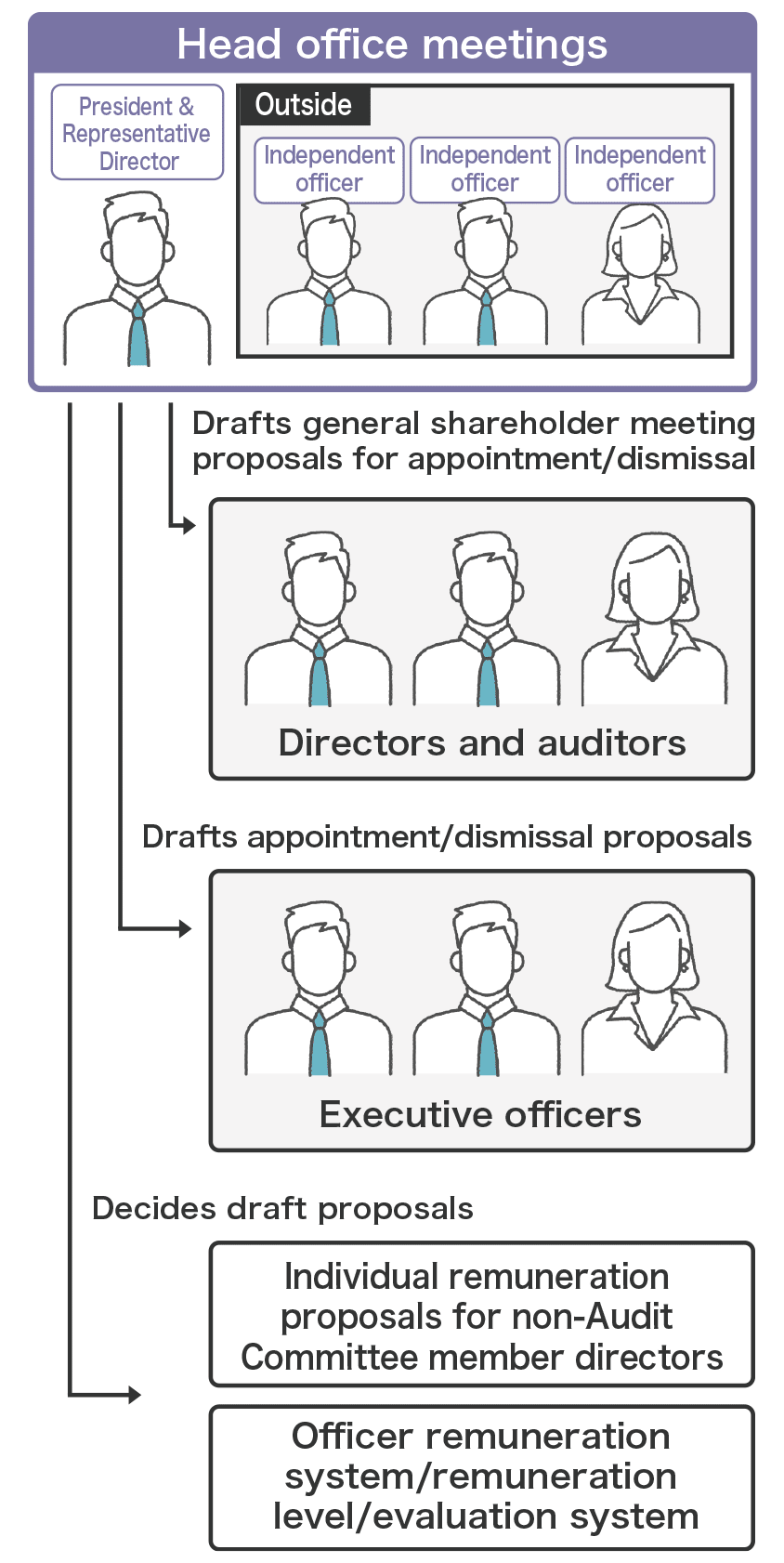

The full-time Auditors Committee member attends important company meetings, such as periodic meetings of the management committee and head office meetings attended by executive directors and core personnel of individual business departments, to share information on the state of management and progress with business plans.

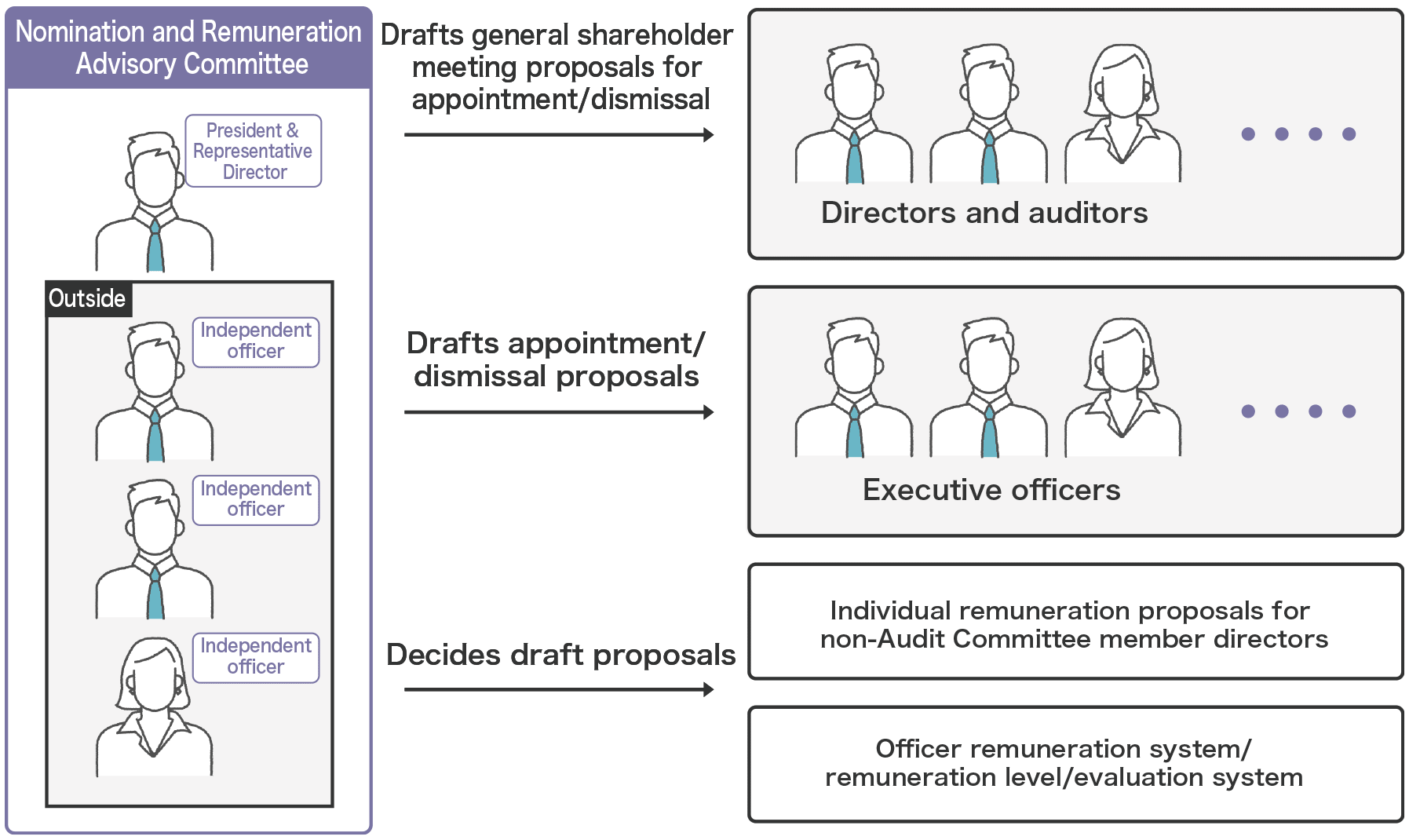

(3) Nomination and Remuneration Advisory Committee

As an advisory body to the board of directors, the Nomination and Remuneration Advisory Committee deliberates and makes decisions on matters such as director nomination and remuneration.

A majority of its membership consists of external directors to enhance the independence and transparency of nomination and remuneration.

The Company has established the Nomination and Remuneration Advisory Committee as an advisory body to the board of directors to strengthen the independence, objectivity, and accountability of board functions related to matters such as nomination and remuneration of directors.

The current Committee consists of four members, three of whom are independent extennal directors.

In the nomination process, the Nomination and Remuneration Advisory Committee makes decisions on draft resolutions for regular general meetings of shareholders regarding the appointment and dismissal of directors who are not members of the Auditors Committee and directors who are members of the Auditors Committee; proposals for the appointment and dismissal of the Representative Director, managing directors, and Executive Officers; the proposed assignment of duties of executive directors; and proposed related basic policies on these matters. It also deliberates on matters such as those related to succession plans.

Members of senior management, including the CEO, are subject to annual performance evaluations regarding matters such as the status of achievement of business performance objectives and deliberations on reappointment based on the evaluations by the Nomination and Remuneration Advisory Committee.

With regard to remuneration, the Nomination and Remuneration Advisory Committee makes decisions on proposed remuneration amounts for individual directors who are not members of the Auditors Committee and deliberates on policies governing remuneration decisions, including the establishment of and revisions to officers’ remuneration systems, remuneration levels, and evaluation systems, and makes decisions on related proposals.

We are implementing each and every one of the principles of the Corporate Governance Code.

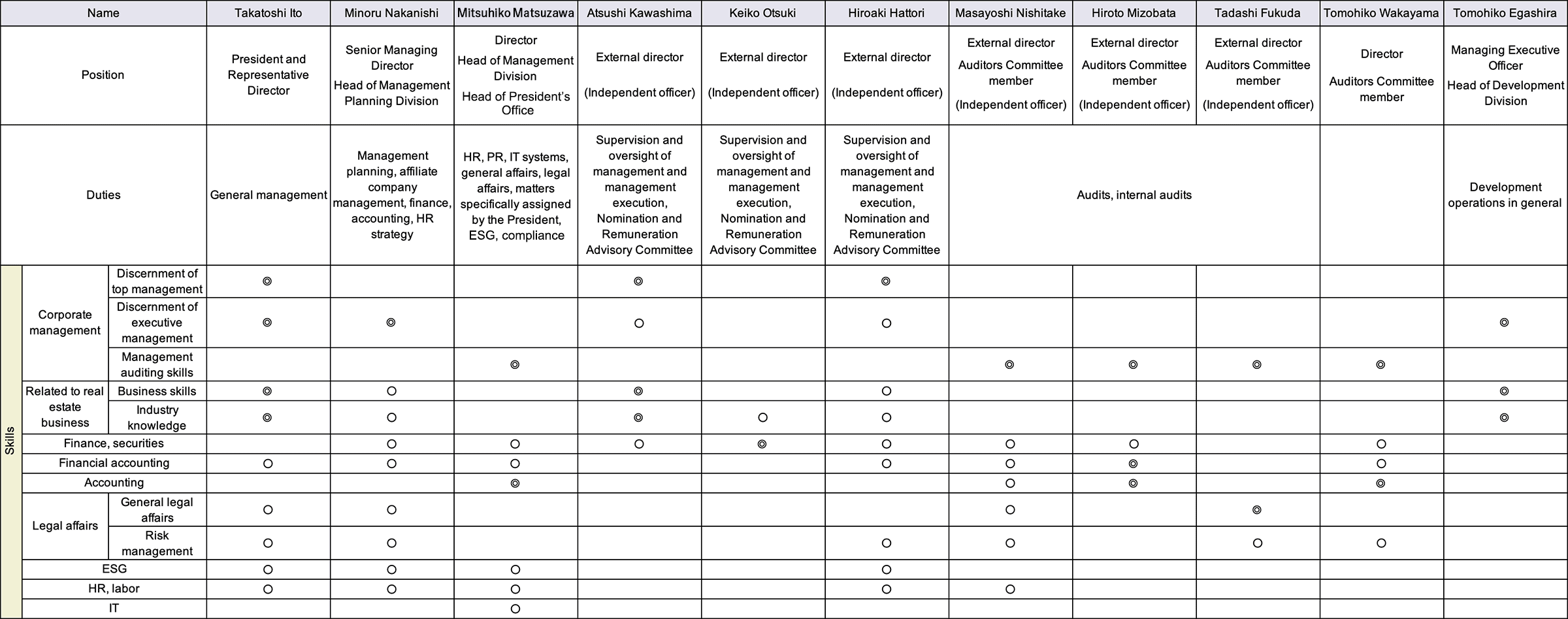

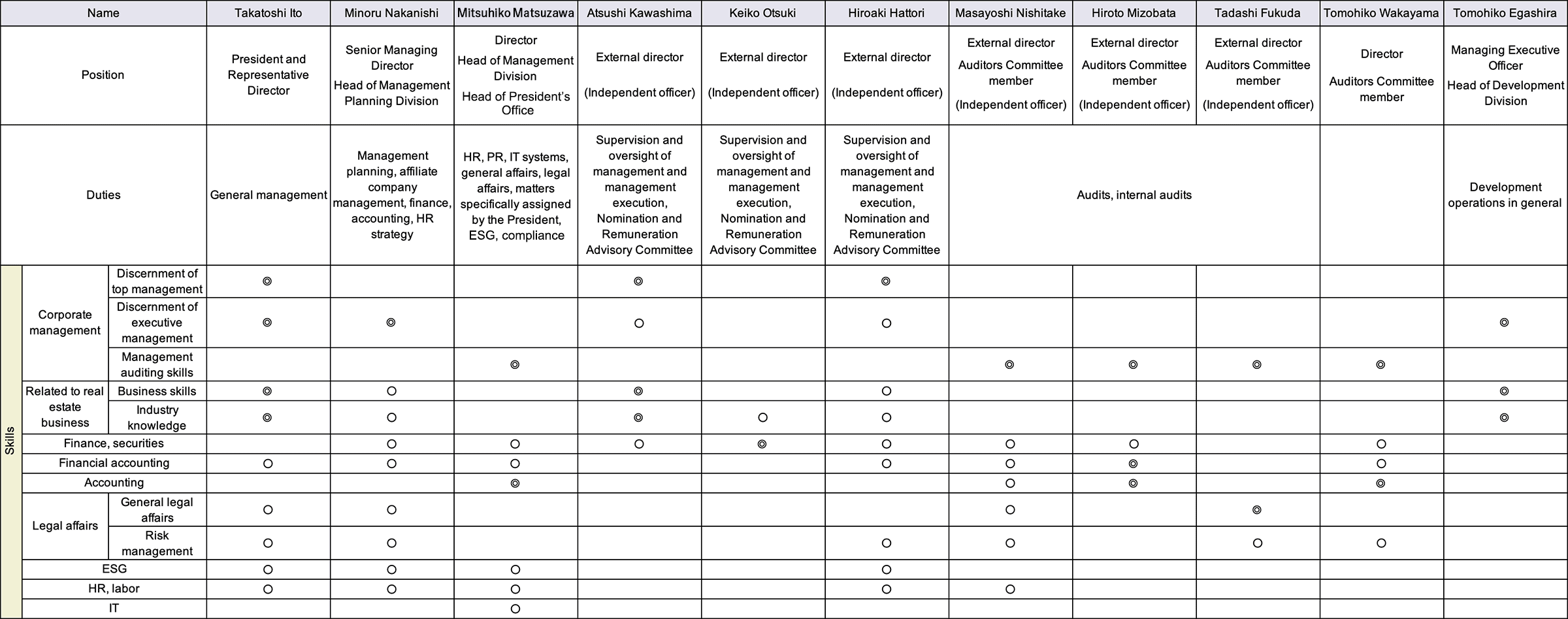

Officer Skills Matrix (◎: outstanding skills; 〇: high skills)

[Notes]

*1 The Tokyo Stock Exchange has been notified that this director serves as an independent officer.

*2 Delegated Executive Officer

Thorough Compliance

Based on our Corporate Ethics and Conduct Charter, which declares our implementation of corporate ethics and social responsibility, we have set out a Compliance Code of Conduct and a Compliance Manual so that officers and employees behave in a way that conforms to laws, regulations, our Articles of Incorporation, and social norms, and have established a thorough enforcement structure in our Compliance Regulations. Full implementation of these is achieved through the instructions of the compliance officer and cooperation of the compliance department and each other department.

Comprehensive Disclosure of Non-Financial Information

In addition to timely disclosure on our website and the annual General Meeting of Shareholders, we strive to provide opportunities for dialogue with shareholders, including financial results briefings and individual IR briefings for both Japanese and overseas investors. Furthermore, we are making efforts to provide comprehensive disclosure of information of concern to stakeholders (especially non-financial information), such as describing our process for determining directors’ compensation by category in our corporate governance report in March 2020 and adding a page on ESG initiatives to our corporate website in April 2020.

Communication with Stakeholders

Communication with Shareholders

We strive to create opportunities for dialogue with shareholders through initiatives such as holding accounts briefing meetings, distributing videos and conducting individual IR activities in Japan and abroad and also by using web conferences, in addition to timely disclosure through our website and the general meeting of shareholders held once a year.

In addition, we actively provide information transmission to and opportunities for communication with overseas shareholders by promoting information disclosure through English-language materials.

Communication with Customers and Business Partners

We work to create products that provide security, safety and comfort as a “life developer.”

We also strive to enhance customer satisfaction with a Customer Service Committee that is made up of members selected from each department.

Communication with Employees

With a whistleblowing system, work environment surveys and other opportunities created for dialogue with employees, we have established a structure for prevention or prompt handling of harassment and compliance violations.

Risk Management

We have set out our basic policy on risk management in the Risk Management Regulations and the ways to combat risks in the event that they occur in the Crisis Management Regulations.

For risks associated with development businesses, we have all business risks checked in detail and determine the policy for dealing with them on such occasions as the divisional meetings held once a week with directors and department heads as members.

In addition, along with having screening methods and structures in place for business risks, legal risks, etc., risks are checked at multiple levels by the development business segment, management segment and president upon entering into real estate sale and purchase agreements or other significant agreements.

Monitoring of the status of risks across the organization and company-wide information sharing are conducted at the meetings of the Risk Management Committee held once a week. The Risk Management Committee strives for timely information-sharing and decision-making on the policy for dealing with a wide range of risks, such as compliance risks, legal risks, labor risks and safety management risks.

Fiscal 2024 Results

Risk Management Committee meetings: 60

Respect for Human Rights

To bolster our initiatives related to human rights, based on an awareness of the importance of safeguarding the human rights of all stakeholders involved in our businesses, we carry out due diligence on human rights based on the Chubu Electric Power Group Basic Human Rights Policy and work to identify, evaluate, prevent, mitigate, and correct human rights issues within the Group.